Britain’s electronic payment systems are being targeted by Russian criminals as part of a money laundering operation worth hundreds of millions of pounds, a new report has found.

The investigation by Transparency International (TI) Russia has revealed that money launderers are purchasing business bank accounts on the dark web and using them to transfer funds across borders. In the UK alone, the e-payment sector processed over £500 billion in transactions during 2020/21, with 40 per cent flagged as high-risk for money laundering.

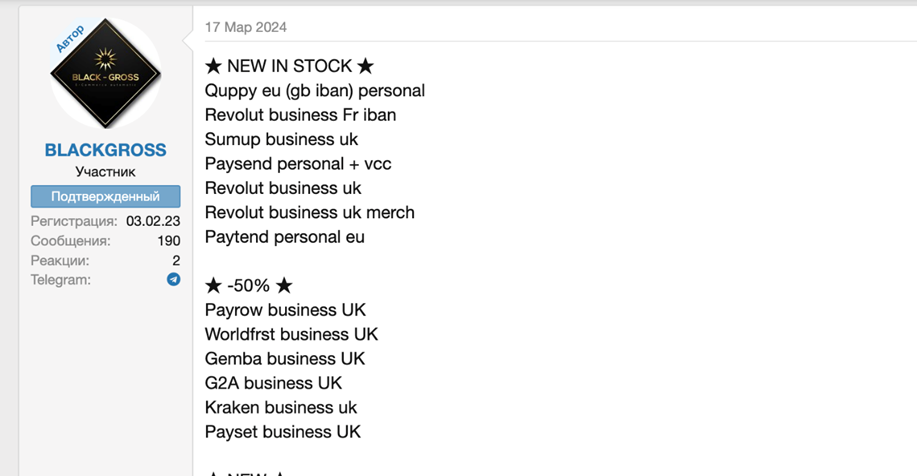

E-payment accounts, used for electronic payments of goods and services, are registered and sold under stolen identities. TI reports that this method allows the criminals to avoid detection, launder money with minimal risk, and evade EU sanctions.

The report comes as Dmitry Birichevsky, a senior Russian Foreign Ministry official, recently stated that Russia is preparing for “decades” of sanctions and views them as a long-term reality to work around.

Kristine Baghdasaryan, the report author told National Security News: “The persistence of money laundering activities through e-payment systems, despite stringent Anti-Money Laundering (AML) procedures, underscores a critical gap in the regulatory framework.”

These loopholes, Baghdasaryan warns, pose “significant national security risks,” as laundered funds can be used to finance terrorism, organised crime, and influence operations aimed at undermining democratic institutions. The TI investigation uncovered the role of dark web marketplaces where verified e-payment business accounts are sold. The online marketplaces provide a platform for criminals to connect with both sellers and buyers.

Sellers on the dark web claimed to be using genuine identification documents for the accounts, which were registered in the names of citizens from Latvia, Estonia, and the UK.

The investigation found the account were registered across several European countries such as Bulgaria, Poland, Spain, Italy, France, Ukraine, and the UK.

Prices for these accounts ranged from USD 150 for personal accounts to USD 1000-1800 for business accounts, with business accounts being more frequently used due to their higher transaction limits.

While the UK government has applied measures to address the loopholes in the e-payment industry, the report suggests that they have not been sufficient.

The increase in e-payment registrations across Europe from 2020 to 2024 is reflective of Russian actors’ efforts to find alternative ways to evade EU sanctions, stated TI.

In the UK, e-payment companies account for 18% of all suspicious activity reports related to money laundering. The report states that the figure is considered disproportionate as the sector handles significantly fewer transactions than traditional banks

Baghdasaryan stated that current AML measures are not sufficient as “money laundering activities within the e-payment sector have persisted and become increasingly sophisticated.”

The situation is further complicated by the involvement of politically exposed persons (PEPs) and complex corporate structures.

The report found that UK e-payment platforms such as Gemba Finance and Paysend are connected to individuals with ties to influential political and economic networks in Russia.

Baghdasaryan highlighted the use of complex corporate structures, stating, “This includes the use of front companies and shell corporations in jurisdictions with less stringent transparency requirements.”

Baghdasaryan said that the use of complex corporate networks across multiple jurisdictions, including those in Cyprus and Malta, “makes it challenging to identify the ultimate beneficiaries of these funds, further complicating efforts to combat money laundering.”

Baghdasaryan calls for stricter regulatory controls, increased cooperation between countries, and better ways to enforce these rules. “The UK must take decisive action to protect its financial system and national security from the threat of money laundering,” the expert warns.